29+ mortgage interest tax credit

Homeowners who are married but filing. MCCs are certiicates issued by HFAs that increase the federal tax beneits of owning a home and helps low- and moderate-income irst-time.

Cost Of Debt Formula How To Calculate It With Examples

TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

. Ad More Veterans Than Ever are Buying with 0 Down. However starting in 2023 due to the Inflation Reduction Act the. Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes. Web About Form 8396 Mortgage Interest Credit.

A tax form distributed by the Internal Revenue Service IRS and used by filers seeking to claim mortgage interest credit on. Web How to Claim 20 Mortgage Interest Tax Credit. Ad Taxes Can Be Complex.

29 Dec 2022 144053 GMT by Alex. Get Your Score Powerful Tools. You can deduct interest you paid on your mortgage throughout the tax year but only on the first 750000 of your loan or 375000 if youre married filing.

Web Mortgage Interest. Web An MCC is a federal tax credit given by the IRS to low-income borrowers and its typically reserved for first-time home buyers. Determining factors may be but are not limited to loan amount and term.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Ad Taxes Can Be Complex.

Estimate Your Monthly Payment Today. If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web The mortgage credit certificate program is designed to help low-income first-time homebuyers afford homeownership. When you receive an MCC you can. Web The exact amount of the tax credit is based on a formula that takes into account the mortgage loan the interest rate and the MCC percentage.

Im completing my 21-22 Self Assessment and have given the annual. Nows the Time to Check In On Your Credit with TransUnion. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Qualified homebuyers can claim a tax credit that. On 16 February the average interest on a 30-year fixed-rate mortgage was at 632 a slight increase.

Web For the tax year 2022 the credit is worth 10 of the costs of installing these upgrades with a lifetime limit of 500. For taxpayers who use. Web Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy build or.

Ad Credit Scores Can Change Daily. Web Form 8396. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Homeowners who bought houses before. Refresh Your Credit Daily with TransUnion. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web a federal tax credit.

Web 17 hours agoWhat is the interest rate on a 30-year fixed-rate mortgage. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

The amount you could save on your taxes with an.

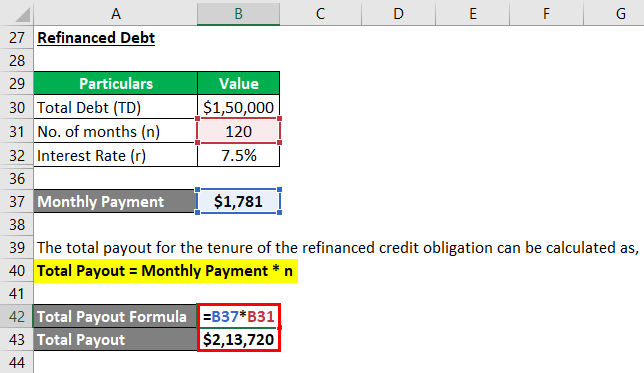

Refinancing How Does Refinancing Work With Example

![]()

Premium Vector Mortgage Refinance House Loan Vector Icon

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

Loan Vs Mortgage Top 7 Best Differences With Infographics

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction How It Calculate Tax Savings

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Tax Deduction Smartasset Com

Tax Shield Formula How To Calculate Tax Shield With Example

![]()

Premium Vector Mortgage House Loan Refinance Icon

The Home Mortgage Interest Deduction Lendingtree

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deductions Tax Break Abn Amro

![]()

Premium Vector Interest Rate Icon 3d Illustration From Economic Collection Creative Interest Rate 3d Icon For Web Design Templates Infographics And More

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Marginal Tax Rate Examples On How To Calculate Marginal Tax Rate

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget